The Company will be taking advantage of temporary rules that relax some of the requirements for a crowdfund offering.

In March 2020, the SEC passed a Temporary Final Rule intended to assist small businesses with capital raising in the Regulation Crowdfunding market due to the COVID-19 pandemic and relaxed or modified some rules for offerings initiated through February 28, 2021 (As extended in August 2020.). This offering is taking advantage of some or all of these relaxed rules which may create additional risks for investors.

Pursuant to SEC Rule §227.20J(z)(2) the Company is launching the Offering prior to providing financial statements.

The financial information that has been omitted is not currently available and will be provided by an amendment to the offering materials. Following the filing of this amendment investors should review the complete set of offering materials including previously omitted financial information prior to making an investment decision. No investment commitments will be accepted until after such financial information has been provided. Failure of the investor to review these financial statements when they are provided could result in the investor not understanding the Company's financial position.

The Company may choose to close the Offering as soon as the target fundraising amount is met. Pursuant to SEC Rule §227.20l(z)(l)(iv)(C) the Company may close the Offering sooner that the required 21 days should the Target Amount be met early. While investors will be notified in advance if the Offering is closed early, this creates additional risks for investors by not allowing additional time to fully assess the transaction.

Investors may only cancel their commitment to invest during the first 48 hours after such commitment.

Pursuant to SEC Rule §227.20l(z)(l)(iv)(D) the Company may limit investor cancellations after 48 hours following their commitment unless there is a material change in the Offering. This increases risk for investors as they will be fully committed to the Offering 48 hours after their initial commitment.

Risks Related to the Company's Business and Industry

The development and commercialization of our products is highly competitive.

We face competition with respect to any products that we may seek to develop or commercialize in the future. Our competitors include major companies worldwide. These competitors also compete with us in recruiting and retaining qualified personnel and acquiring technologies.

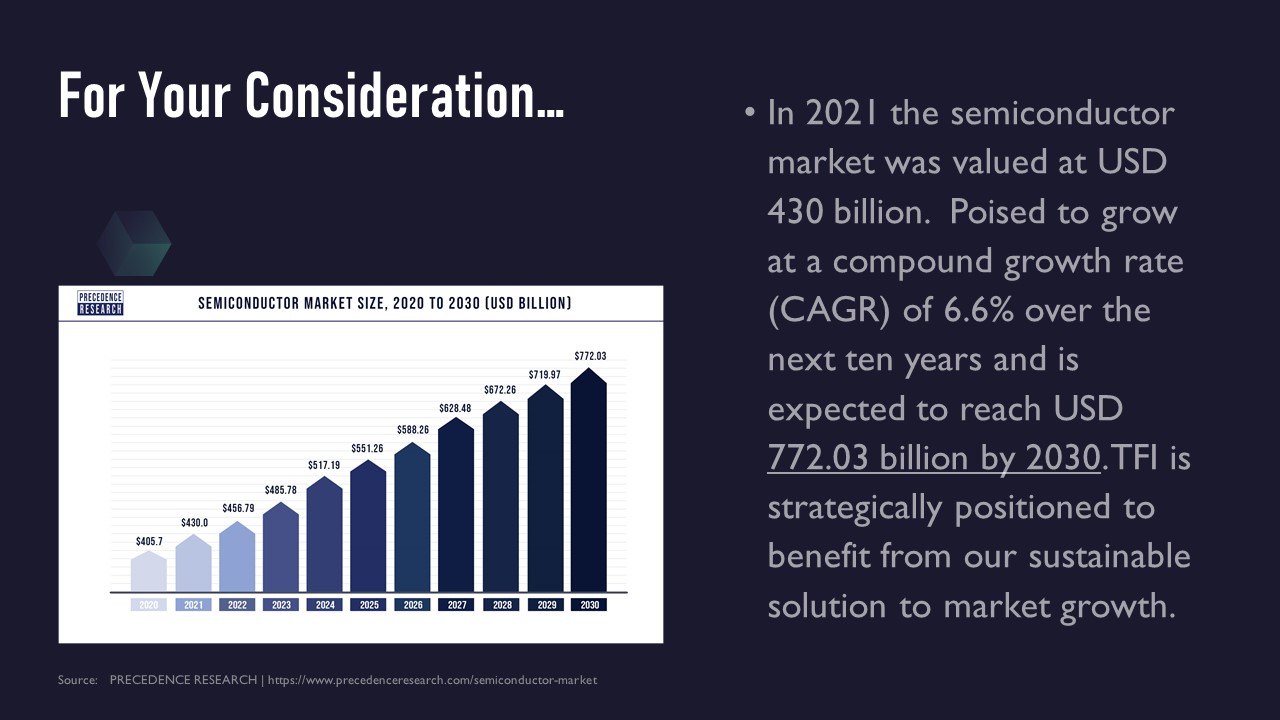

In general, demand for our products and services is highly correlated with general economic conditions.

A substantial portion of our revenue is derived from discretionary spending by individuals, which typically falls during times of economic instability. Declines in economic conditions in the U.S. or in other countries in which we operate may adversely impact our consolidated financial results. Because such declines in demand are difficult to predict.

The amount of capital the Company is attempting to raise in this Offering is not enough to sustain the Company's current business plan.

In order to achieve the Company's near and long-term goals, the Company will need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we will not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause an Investor to lose all or a portion of his or her investment.

Demand for and pricing of our products are subject to economic conditions and other factors present in the various markets where the products are sold.

Consumer preferences also impact the demand for new electric bikes purchases. A decrease in demand due to any of these factors would have a negative effect on our business and operations. Volatility in that market (which could be affected by many different factors, including general economic conditions, energy prices and trade policy) will likely affect the company. With a global supply chain, events across the world can affect supply chain reliability.

Our product may be subject to emergent regulations.

Legislation by state, federal or other national bodies may affect semiconductor manufacturing from: the standpoint of environmental quality and waste materials. New and existing laws may impact our ability to sell our product.

The Company's business and operations are sensitive to general business and economic conditions in the United States and other countries that the Company operates in.

A host of factors beyond the Company's control could cause fluctuations in these conditions. Adverse conditions may include recession, downturn or otherwise, local competition or changes in consumer taste. These adverse conditions could affect the Company's financial condition and the results of its operations.

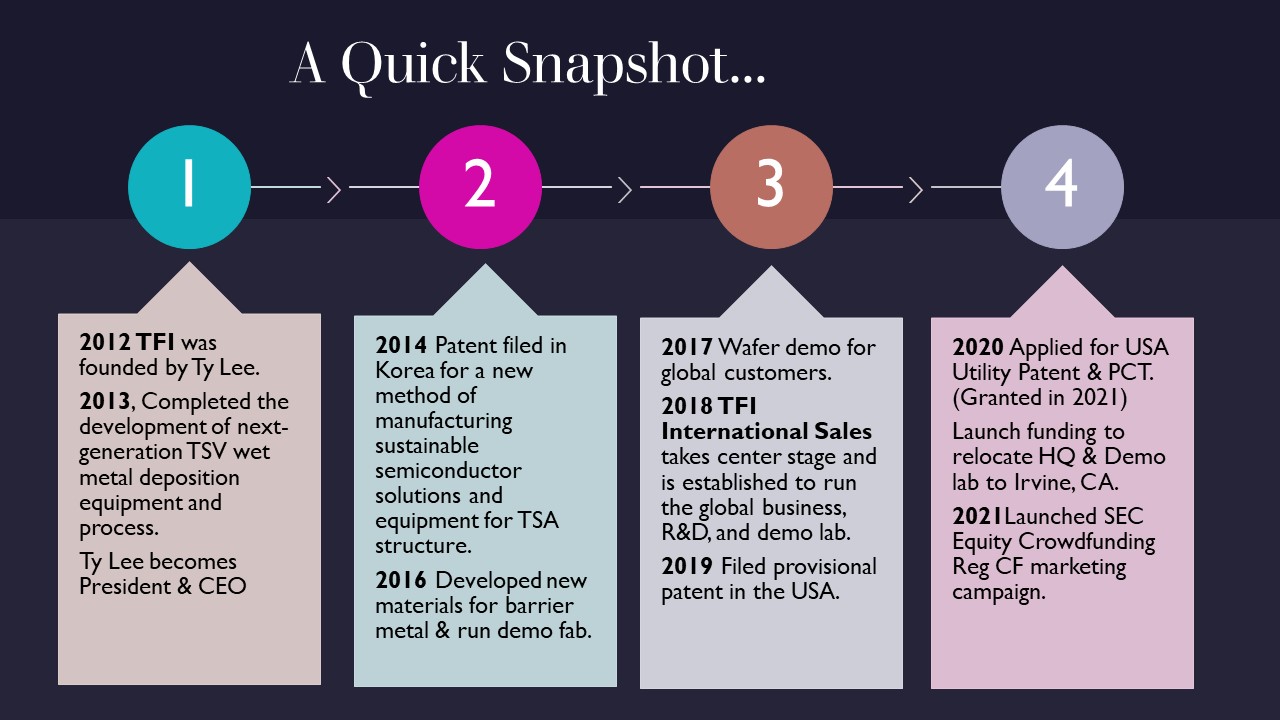

We rely on various intellectual property rights, including patents in order to operate our business.

Such intellectual property rights, however, may not be sufficiently broad or otherwise may not provide us a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented or designed around, particularly in countries where intellectual property rights are not highly developed or protected. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons, or countries may require compulsory licensing of our intellectual property. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights.

As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. In order to protect or enforce our patent rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management's attention from other business concerns. The law relating to the scope and validity of claims in the technology field in which we operate is still evolving and, consequently, intellectual property positions in our industry are generally uncertain. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

We have not prepared any audited financial statements.

1

Therefore, you have no audited financial information regarding the Company's capitalization or assets or liabilities on which to make your investment decision. If you feel the information provided is insufficient, you should not invest in the Company.

We are not subject to Sarhanes-Oxley regulations and lack the financial controls and safeguards required of public companies.

We do not have the internal infrastructure necessary, and are not required, to complete an attestation about our financial controls that would be required under Section 404 of the Sarbanes Oxley Act of 2002. There can be no assurance that there are no significant deficiencies or material weaknesses in the quality of our financial controls. We expect to incur additional expenses and diversion of management's time if and when it becomes necessary to perform the system and process evaluation, testing and remediation required in order to comply with the management certification and auditor attestation requirements.

In addition to the risks listed above, businesses are often subject to risks not foreseen or fully appreciated by the management.

It is not possible to foresee all risks that may affect us. Moreover, the Company cannot predict whether the Company will successfully effectuate the Company's current business plan. Each prospective Purchaser is encouraged to carefully analyze the risks and merits of an investment in the Securities and should take into consideration when making such analysis, among other, the Risk Factors discussed above.

Risks Related to the Securities

The Securities will not he freely tradahle until one year from the initial purchase date. Although the Securities may he tradahle under federal securities law, state securities regulations may apply and each Purchaser should consult with his or her attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or non-United States jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Purchasers should be aware of the long-term nature of their investment in the Company. Each Purchaser in this Offering will be required to represent that it is purchasing the Securities for its own account, for investment purposes and not with a view to resale or distribution thereof.

Neither the Offering nor the Securities have been registered under federal or state securities laws, leading to an absence of certain regulation applicable to the Company.

No governmental agency has reviewed or passed upon this Offering, the Company or any Securities of the Company. The Company also has relied on exemptions from securities registration requirements under applicable state securities laws. Investors in the Company, therefore, will not receive any of the benefits that such registration would otherwise provide. Prospective investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering on their own or in conjunction with their personal advisors.

No Guarantee of Return on Investment

There is no assurance that a Purchaser will realize a return on its investment or that it will not lose its entire investment. For this reason, each Purchaser should read the Form C and all Exhibits carefully and should consult with its own attorney and business advisor prior to making any investment decision.

A majority of the Company is owned by a small number of owners.

Prior to the Offering the Company's current owners of 25% or more beneficially own up to 80% of the Company. Subject to any fiduciary duties owed to our other owners or investors under California law, these owners may be able to exercise significant influence over matters requiring owner approval, including the election of directors or managers and approval of significant Company transactions, and will have significant control over the Company's management and policies. Some of these persons may have interests that are different from yours. For example, these owners may support proposals and actions with which you may disagree. The concentration of ownership could delay or prevent a change in control of the Company or otherwise discourage a potential acquirer from attempting to obtain control of the Company, which in turn could reduce the price potential investors are willing to pay for the Company. In addition, these owners could use their voting influence to maintain the Company's existing management, delay or prevent changes in control of the Company, or support or reject other management and board proposals that are subject to owner approval.

The Company has the right to extend the Offering deadline.

The Company may extend the Offering deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Minimum Amount even after the Offering deadline stated herein is reached. Your investment will not be accruing interest during this time and will simply be held until such time as the new Offering deadline is reached without the Company receiving the Minimum Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Minimum Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after release of such funds to the Company, the Securities will be issued and distributed to you.

There is no present market for the Securities and we have arbitrarily set the price.

We have arbitrarily set the price of the Securities with reference to the general status of the securities market and other relevant factors. The Offering price for the Securities should not be considered an indication of the actual value of the Securities and is not based on our net worth or prior earnings. We cannot assure you that the Securities could be resold by you at the Offering price or at any other price.

Your ownership of the Shares of Common Stock will be subject to dilution.

Owners of common stock do not have preemptive rights. If the Company conducts subsequent Offerings of Common Stock or Securities convertible into Common Stock, issues shares pursuant to a compensation or distribution reinvestment plan or otherwise issues additional shares, investors who purchase shares in this Offering who do not participate in those other stock issuances will experience dilution in their percentage ownership of the Company's outstanding shares. Furthermore, shareholders may experience a dilution in the value of their shares depending on the terms and pricing of any future share issuances (including the shares being sold in this Offering) and the value of the Company's assets at the time of issuance.

The Securities will be equity interests in the Company and will not constitute indebtedness.

The Securities will rank junior to all existing and future indebtedness and other non-equity claims on the Company with respect to assets available to satisfy claims on the Company, including in a liquidation of the Company. Additionally, unlike indebtedness, for which principal and interest would customarily be payable on specified due dates, there will be no specified payments of dividends with respect to the Securities and dividends are payable only if, when and as authorized and declared by the Company and depend on, among other matters, the Company's historical and projected results of operations, liquidity, cash flows, capital levels, financial condition, debt service requirements and other cash needs, financing covenants, applicable state law, federal and state regulatory prohibitions and other restrictions and any other factors the Company's board of directors deems relevant at the time. In addition, the terms of the Securities will not limit the amount of debt or other obligations the Company may incur in the future. Accordingly, the Company may incur substantial amounts of additional debt and other obligations that will rank senior to the Securities.

There can be no assurance that we will ever provide liquidity to Purchasers through either a sale of the Company or a registration of the Securities.

There can be no assurance that any form of merger, combination, or sale of the Company will take place, or that any merger, combination, or sale would provide liquidity for Purchasers. Furthermore, we may be unable to register the Securities for resale by Purchasers for legal, commercial, regulatory, market-related or other reasons. In the event that we are unable to effect a registration, Purchasers could be unable to sell their Securities unless an exemption from registration is available.

The Company does not anticipate paying any cash dividends for the foreseeable future.

The Company currently intends to retain future earnings, if any, for the foreseeable future, to repay indebtedness and to support its business. The Company does not intend in the foreseeable future to pay any dividends to holders of its shares of preferred stock.

The Company has the right to conduct multiple closings during the Offering.

If the Company meets certain terms and conditions, and more than thirty (30) days remain before the Offering Deadline, an intermediate close of the Offering can occur, which will allow the Company to draw down on the first $100,000 of the proceeds of the offering committed and captured during the relevant period, as well as any amounts raised after. The Company may choose to continue the Offering thereafter. Purchasers should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Purchasers previously closed upon will not have the right to re-confirm their investment as it will be deemed completed.

The Company has the right to extend the Offering Deadline.

The Company may extend the Offering Deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Target Amount even after the Offering Deadline stated herein is reached. While you hav the right to cancel your investment in the event the Company extends the Offering, if you choose to reconfirm your investment, your investment will simply be held until such time as the new Offering Deadline is reached without the Company receiving the Target Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Target Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after release of such funds to the Company, the Securities will be issued and distributed to you.